Investment in technology stocks is considered one of the best strategies for long-term wealth generation. Among those, Goldstone Technologies had been gaining attention due to its steadily growing potential for future returns. In this blog, we discuss the share price target of Goldstone Technologies, starting from 2025 and moving to 2030, considering financial performance, market trend, and expert analysis in this regard.

About Goldstone Technologies

Goldstone Technologies is engaged in IT services and consultancy in data analytics, Artificial Intelligence, and software development that has survived ups and down in the market and is growing consistently.

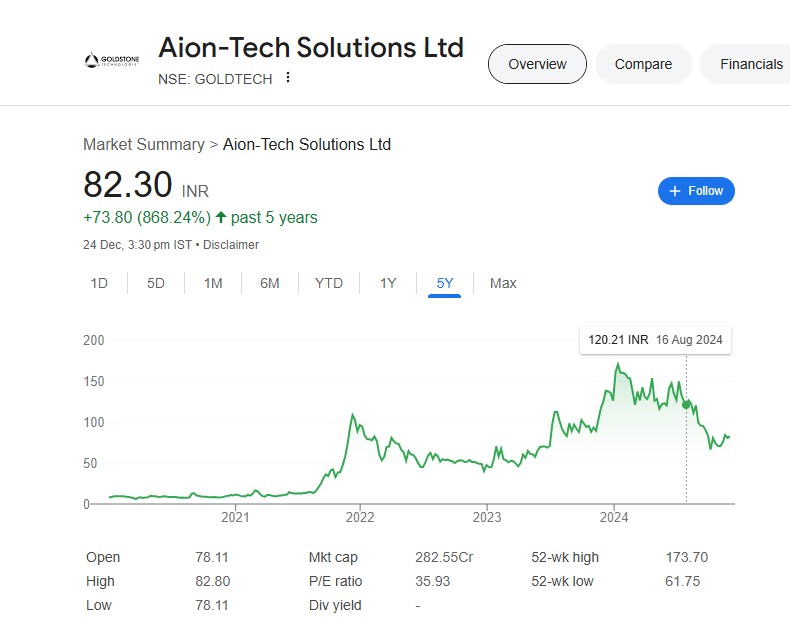

Goldstone Tech Share Price Chart

Recent Performance Overview

- 52-Week Range: ₹61.75 – ₹173.70

- Current Price (Dec 2024): ₹82.50

- Market Cap: ₹282 crore

- Book Value: ₹19.40

- EPS (TTM): ₹2.30

After having gone through a year of difficult times with the net sales shrinking by 19.14% YoY as of September 2024, the company has emerged promisingly as it records an improvement in profitability, besides recording enhanced institutional investment in its share.

Goldstone Technologies Share Price Target Table 2025-2030

With the history of growth, the market potential, and expert projections for Goldstone Technologies, the projected share price target will be as follows:

| Year | Minimum Price (₹) | Average Price (₹) | Maximum Price (₹) |

|---|

| 2025 | 100 | 120 | 140 |

| 2026 | 130 | 150 | 180 |

| 2027 | 160 | 190 | 220 |

| 2028 | 200 | 230 | 260 |

| 2029 | 250 | 280 | 310 |

| 2030 | 300 | 340 | 380 |

Shareholding Pattern For Goldstone Tech Share

Factors Driving Growth

- Market Expansion

Goldstone Technologies has been aggressively expanding its market outreach, especially in data analytics and AI-driven solutions. These sectors are expected to grow very fast and open up rich opportunities for the company. - Improved Financial Metrics

With a strong Piotroski Score indemnating financial strength, improved earnings quality is persistently pursued by Goldstone Technologies. This growth from losses to profits QonQ underlines the operational efficiency of the Company. - FII/Institutional Interest

Increased shareholding by FIIs and other institutions shows conviction in long-term potential. Such additions often happen much before a considerable movement in stock price. - Sectoral Growth

With increased digitization, government initiatives, and global demand for outsourcing, the growth of the IT and consulting sector in India will be very high.

Challenges to Consider

- High Volatility: IT can be highly volatile and may move according to global economic factors and market sentiment.

- Competitive Landscape: There is tough competition provided by larger players in the IT consulting space that may affect Goldstone Technologies’ market share.

- Interest Payments: The high ratio of interest to earnings, though reduced, is a cause for concern and may lead to a squeeze on profitability if not properly addressed.

Expert Views on Goldstone Tech Share

Financial analysts view Goldstone Technologies as an average performer due to its steady financial performance, coupled with moderate price momentum. Being an innovation-based company, its readiness for adaptation to the emergent trends in the market signals bright prospects for growth ahead.

Conclusion

Goldstone Technologies, despite recent ups and downs in financial performance, continues to have strong fundamentals and is fast building a presence in markets that are considered an interesting investment avenue for investors in search of exposure to this industry. However, investors should tread with a level of caution, having in mind the fact that an element of risk may be contained in the stock market. This is especially true when considering diversification and periodic portfolio reviews, which are paramount in containing risks.