Impex Ferro Tech Ltd, a notable player in the ferro manganese industry, has experienced significant challenges in recent years. Specializing in ferro alloys manufacturing, the company is currently undergoing a Corporate Insolvency Resolution Process (CIRP). Despite these hurdles, investor interest remains high due to its recovery potential.

Current Stock Performance

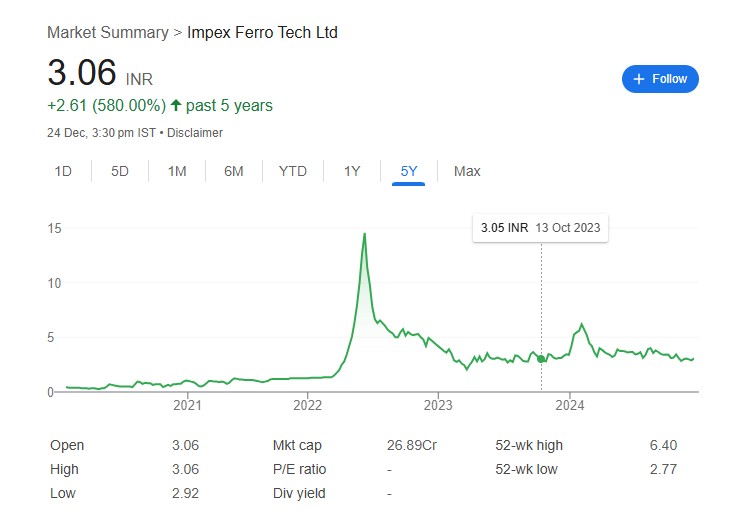

As of December 24, 2024, the stock is priced at ₹3.06, reflecting a 4.79% gain on the day. Over the past year, its price has ranged between ₹2.77 and ₹6.40, showcasing significant volatility. Understanding future price trends depends on the resolution of its insolvency and market developments.

Impex Ferro Tech Share Price Chart

Price Target Analysis for 2025

Several factors are likely to influence Impex Ferro Tech Ltd’s stock performance in 2025. These include:

- Insolvency resolution outcomes.

- Fluctuations in ferro manganese prices.

- Market dynamics and broader economic conditions.

While the potential for growth exists, caution is warranted due to the inherent uncertainties surrounding its recovery.

Financial Overview of Impex Ferro

The company’s financial struggles are evident:

- Revenue (FY 2023-24): ₹275.02 million, marking an 80.82% decline year-on-year.

- Net profit margin (Q4 2023-24): -57.12%.

Impex Ferro Tech Share Price Target 2025-2030

Based on current data and market trends, here is a year-wise projection:

| Year | Projected Share Price (INR) |

|---|---|

| 2025 | ₹4.16 |

| 2026 | ₹4.80 |

| 2027 | ₹5.20 |

| 2028 | ₹5.40 |

| 2029 | ₹6.24 |

| 2030 | ₹6.80 |

Key Factors Influencing Price Targets

- Insolvency Resolution: A successful restructuring or asset sale could positively impact the share price of Impex Ferro Tech.

- Market Sentiment: A boost in the ferro alloys sector, particularly if manganese demand rises, could enhance stock performance.

- Financial Recovery: Improved financial performance and operational efficiency are critical for sustainable growth.

- Industry Trends: Growth in infrastructure projects and steel production could drive ferro manganese demand, benefitting Impex Ferro Tech Ltd.

Shareholding Pattern For Impex Ferro Tech

Long-Term Outlook of Impex Ferro Share (2025-2030)

According to Wallet Investor, the stock may see gradual appreciation, with a projected price of ₹6.24 by December 2029.

Conclusion

Impex Ferro Tech Ltd is at a critical juncture. While the insolvency process and financial struggles present significant risks, favorable resolutions and market conditions could drive recovery and growth. Investors should closely monitor developments within the company and the broader ferro manganese industry.

Investment Advice: While the stock holds potential, it comes with considerable risks. Thorough research and cautious decision-making are essential before investing.